How an ESOP Works: Exploring the Unique Process of 100% Employee Ownership

Unravel the intricacies of ‘How an ESOP Works’ with our perceptive analysis of 100% Employee Stock Ownership Plans, a dynamic model driving unprecedented employee engagement and business success.

Understanding 100% ESOPs

A 100% ESOP redefines traditional business structures, transforming employees into co-owners. This model encourages a rewarding and inclusive work culture, propelling the company towards common growth.

Implementing a 100% ESOP structure can significantly reduce a company’s tax burden, while increasing employee loyalty and productivity.

Comprehending 100% ESOPs reveals a dual benefit. It not only promotes an accumulation of retirement savings for employees, but it also fosters a sense of shared responsibility, leading to increased productivity and loyalty.

What is a 100% ESOP?

A 100% Employee Stock Ownership Plan, or ESOP, is a unique employee benefit scheme. In this arrangement, all company stocks are held in trust for the benefit of the employees, transforming them into company co-owners.

This full ownership model of ESOP is compelling as it provides complete equity participation for the workforce. By making employees part-owners, they are directly invested in the company’s progress and success.

Moreover, 100% ESOPs can also be an attractive retirement benefit. Employees, upon retirement or exiting the company, have the option to sell their shares back, ensuring a rewarding retirement savings plan.

Key Features

A 100% ESOP is distinctive in its empowering characteristics, giving employees tangible assets and rights in their work environment, cultivating a profound sense of shared ownership.

- Employees gain shares of the company, often without any upfront cost.

- Depending on the ESOP terms, employees may acquire the right to vote on weighty company decisions.

- ESOPs typically serve as a value-add to other retirement benefits, allowing employees to sell back their shares when they retire or leave the company.

How Does a 100% ESOP Work?

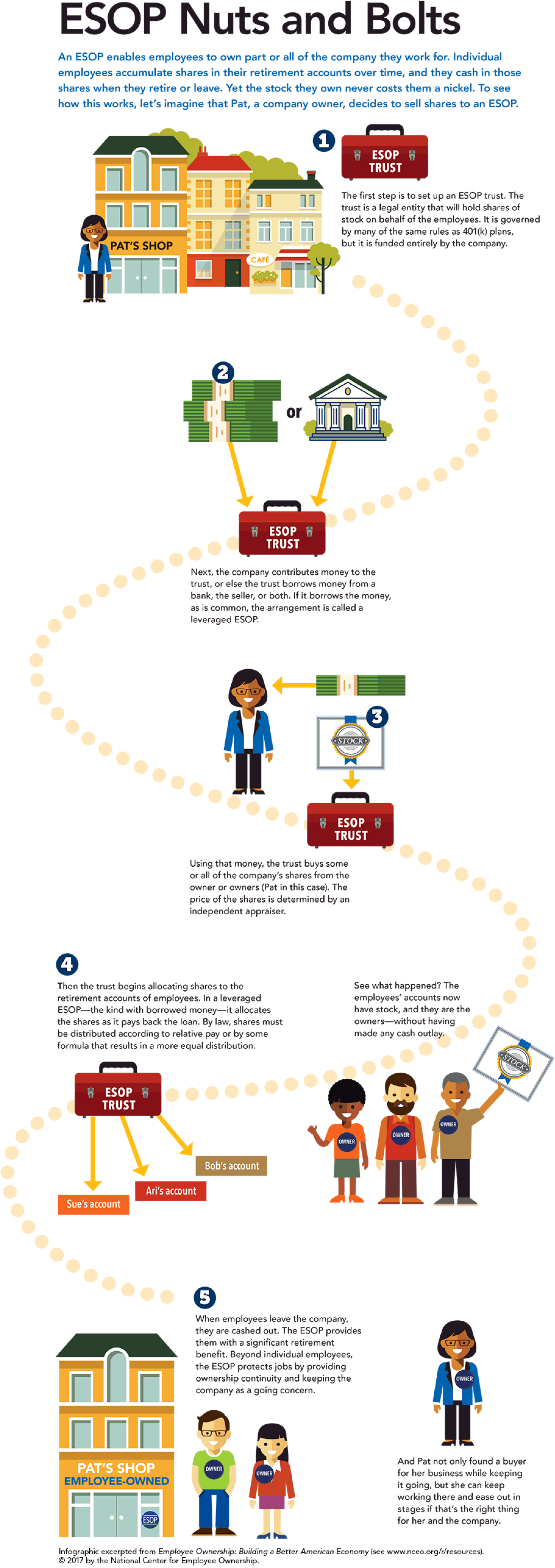

The operational mechanism of a 100% ESOP involves two core steps: establishment and funding. The company sets up an ESOP trust to house shares and then funds the ESOP, usually through a loan that’s dutifully repaid over time.

Understanding the workings of a 100% ESOP involves exploring employee participation. Employees satisfy certain criteria, including tenure, to become eligible. Share ownership increases progressively according to a set vesting schedule.

Formation

Establishing a 100% ESOP initiates with creating an ESOP trust. This specialized trust is formed by the company to hold its shares, paving the way for shared ownership.

The formation phase of a 100% ESOP is pivotal. This stage molds the trajectory of the plan by outlining parameters such as eligibility and share allocation.

A key aspect in birth of an ESOP is its funding. The ESOP acquires company shares often through a loan which the company itself is committed to pay back over time.

Funding the ESOP

Pooling resources allows the ESOP trust to acquire company shares, typically using a loan that the company gradually repays. This economic strategy effectively transitions ownership without employees bearing upfront costs.

The funding phase is the blueprint of financing a 100% ESOP, instrumental to its success. It weaves together various elements like interest rates, loan duration, and collateral, carefully balancing them to ensure a financially viable ESOP for all stakeholders.

At American Mortgage Network, our financial structure is distinct and exceptional. Unlike typical companies, we carry no debt or financial obligations towards our original owners. This sets us apart as a truly unique and extraordinary Employee Stock Ownership Plan (ESOP) entity.

Participation

Engagement in Ownership: Every employee in a 100% ESOP becomes a co-owner. Participation typically depends on an employee’s tenure and sometimes, other considerations set by the company.

The Inner Circle: Eligibility for a 100% ESOP participation isn’t universal. Companies define their criteria, often based on an employee’s length of service, ensuring vested stakeholders working towards the company’s prosperity.

Benefits of a 100% ESOP

Reaping immediate and long-term financial rewards is at the crux of a 100% ESOP’s benefits. This business model allows employees, now co-owners, to participate fully in the fruits of the company’s growth and success.

A 100% ESOP acts as a ladder to progress, with significant advantages relating to employee motivation, tax benefits, and effective succession planning. At a stroke, it transforms employees into invested stakeholders, deepening their involvement and commitment to the business.

Financial Reward

Being part of a 100% ESOP offers considerable financial rewards. Employees, as co-owners, reap benefits from the company’s profits, creating a strong profit-sharing perspective.Over time, this setup fosters wealth accumulation, substantially enhancing employees’ financial stability.

- Profit-Sharing Perspective: Allows employees to benefit directly from the company’s growth and profitability.

- Wealth Accumulation: Facilitates considerable financial growth for employees, reinforcing their economic resilience.

Retirement Savings

100% ESOPs play a crucial role in the retirement savings of employees by serving as a resource they can tap into during their golden years. As the value of the company grows, so too does the employee’s retirement nest egg, promoting long-term financial security.

- Understanding the correlation between company growth and retirement savings in a 100% ESOP

- How ESOP share vesting feeds into pension planning

- The process of selling back shares upon retirement

- Tax benefits associated with ESOPs in retirement

- The role of company performance and ESOPs in guaranteeing a comfortable retirement

Advantages of a 100% ESOP

Shifting to a 100% ESOP model presents an ideal combination of tax benefits, better employee retention, and efficient succession planning for businesses. This strategic move aids in fostering a culture of engagement, commitment, and shared success within the organization.

The true essence of a 100% ESOP lies in its capacity to financially reward employees in the form of company shares. As co-owners, they directly benefit from the company’s prosperity and growth.

Alongside monetary gains, a 100% ESOP also contributes positively to employees’ retirement plans. This additional retirement savings opportunity often complements standard retirement plans, adding an extra layer of financial security for employees.

Case Studies: Success Stories of 100% ESOP Companies

‘ESOP Heroes’ unfolds the chronicles of successful 100% ESOP companies, emphasizing the transformation brought by significant employee ownership. We show you how these companies thrived and outperformed due to this unique model.

In ‘Victory Through Ownership’, we bring to the stage stories of triumph from 100% ESOP companies. Get inspired by these narratives where employee-centric approach led to remarkable growth and sustainability.

- The power of employee ownership symmetry leading to business growth

- Innovative problem-solving strategies stemming from shared ownership

- Retention of talent – The key roles employee ownership plays

- Long-term business sustainability and succession solutions via ESOPs

- Boost in employee morale through enhanced financial security and stability

Frequently Asked Questions

If you’re navigating the ins and outs of 100% ESOPs, it’s only natural to have questions. That’s why we’ve compiled key information addressing common doubts or uncertainties, providing clear and concise answers on a variety of topics.

- Understanding the concept of 100% ESOPs

- The eligibility criteria for participation

- The process of ESOP formation and share allocation

- Retirement benefits and perks associated with ESOPs

- The tax implications for companies and employees

- The positive impact of 100% ESOPs on employee retention

Become a Part of Our Elite Team

At American Mortgage Network, you’re not just joining a company, you’re becoming a member of an elite group of professionals committed to the highest standards of excellence. Our distinctive hiring methodology doesn’t just preserve the quality of our team; it actively enhances the level of service and proficiency in the mortgage lending industry.

Are you prepared to excel in a top-tier environment? Do you have the ambition and drive for continuous professional development and success? If so, American Mortgage Network welcomes you to consider a career with us, where your journey towards outstanding achievements begins.